Redmount welcomes you to Modern Merchant Banking

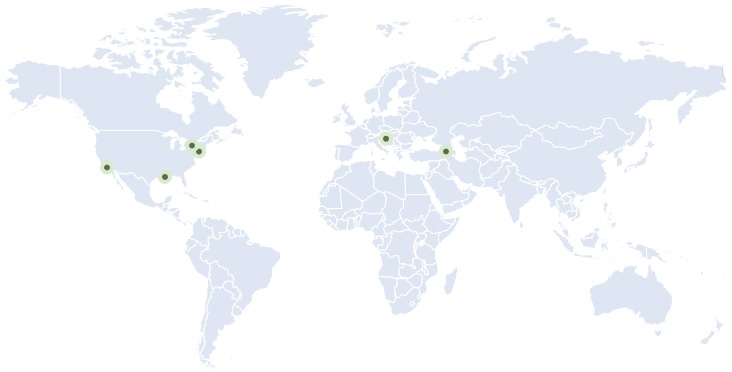

A global platform of investment and financial firms, built since 1994 and connected via significant ownership*, a team of more than 200 professionals across 11 time zones, and united by a vision of "modern merchant banking" to support middle market businesses and investors globally.

Combining collective insights, capital, and connections to grow faster and service middle-market clients better globally

Connect with companies directly to conduct business subject to jurisdictional and regulatory availability.

* - The permanent capital for ownerships of 15.125% to 50.00% in platform companies is provided by Red Mountain, a multi-generational family business group with agri-commodities processing and contract manufacturing operations in the E.U. and the U.S.

HISTORY OF MERCHANT BANKING

At first, starting in the 14th century, bankers operated as merchants, buying crops from farmers and selling them at a profit. Soon, acting more as bankers, they introduced bills of trade as negotiable and tradable financial instruments. This introduced more capital to the trade system and farmers could increase food production to sell to the banks. This created a loop that benefited all parties.

It was a simple business conducted on a bench in a town square where all participating parties had similar interests. Over time banks involved, eventually to what they are now.

Meanwhile, merchant banks have remained committed to their mission of offering capital and generating ideas for enterprise growth, keeping the alignment of interests for all parties still at the heart of the business.

Visit Wikipedia to learn more about merchant banks.

Palazzo of Bartolini Salimbeni, a Florentine merchant banker, built in 1520.